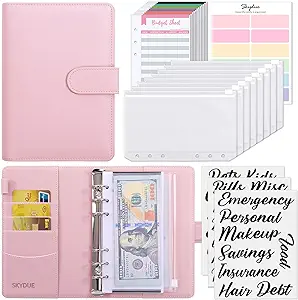

I personally have used this binder to save over $5k.

Budgeting with cash can be an effective way to manage your finances, especially if you prefer tangible methods over digital ones. Here’s a step-by-step guide to budgeting with cash:

- Determine Your Income: Calculate your monthly income after taxes. This is the total amount of money you have available to budget.

- List Your Expenses: Make a list of all your monthly expenses. This can include rent or mortgage, utilities, groceries, transportation, insurance, debt payments, entertainment, and any other regular expenses you have.

- Categorize Your Expenses: Group your expenses into categories such as fixed expenses (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment).

- Set Spending Limits: Assign a specific amount of cash to each expense category based on your budget. Be realistic about how much you need for each category and try to allocate funds accordingly.

- Withdraw Cash: Withdraw the total amount of cash you’ve allocated for each category from your bank account. You may want to do this at the beginning of the month or each time you get paid, depending on your preference.

- Use Envelopes or Dividers: Divide your cash into envelopes or use dividers in your wallet for each spending category. Label each envelope or divider with the name of the category (e.g., “Groceries,” “Transportation”).

- Track Your Spending: Keep track of how much you spend in each category throughout the month. You can use a notebook, a spreadsheet, or budgeting apps specifically designed for cash tracking.

- Adjust as Needed: If you find that you’re consistently overspending in certain categories, you may need to adjust your budget. Consider reallocating funds from one category to another or finding ways to cut back on expenses.

- Roll Over Remaining Cash: At the end of each month, any remaining cash in your envelopes or dividers can be rolled over to the next month or used to build up savings.

- Review Regularly: Regularly review your budget to see how well you’re sticking to your spending limits and identify any areas where you can improve.

By following these steps, you can effectively budget with cash and take control of your finances.

My goal is to run a blog that avoids being overly promotional, yet I value transparency regarding the inclusion of affiliate links. These links are connected to products I truly endorse or have personally bought. The reviews shared here stem from my genuine experiences and opinions. Please note that I might earn a commission if you make a purchase through the provided links.